F & O HIGHLIGHTS

Nifty May 2011 futures closed at 5,536.00, at a discount of 1.15 points over spot closing of 5,537.15, while Nifty June 2011 futures were at 5,547.00 at a premium of 9.85 points over spot closing. The near month May 2011 derivatives contract expires on Thursday, May 26, 2011. Nifty May futures saw addition of 5.47% or 1.45 million (mn) units, taking the total outstanding open interest (OI) to 28.00 mn units.

From the most active underlying, SBI's May 2011 futures closed at a premium of 8.30 points at 2624.70 compared with spot closing of 2616.40. The number of contracts traded was 29,022.

ICICI Bank May 2011 futures were at a premium of 1.05 point at 1057.20 compared with spot closing of 1056.15. The number of contracts traded was 26072.

Tata Motors May 2011 futures were at a premium of 0.45 points at 1159.70 compared with spot closing of 1159.25. The number of contracts traded was 18,095.

Axis Bank May 2011 futures were at a premium of 5.00 points at 1240.00 compared with spot closing of 1235.00. The number of contracts traded was 14,863.

Tata Steel May 2011 futures were at a premium of 2.15 points at 591.40 compared with spot closing of 589.25. The number of contracts traded was 14,652.

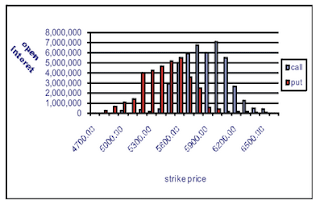

Nifty Option Open Interest Distribution

Nifty May 5600 call added 13.37 lakh shares in OI, up 36.70% and 5700 call added 12.10 lakh shares in OI, up 20.56%. On the put side nifty May 5500 put added 6.44 lakh shares in OI, up 14.29% and 5400 put added 5.54 lakh in OI, up 13.38%. The put-call ratio of stock option increased from 0.32 to 0.34 while put-call ratio of index option increased from 0.75 to 0.83. On the whole the put call ratio was at 0.81.

Read more about Derivative Strategy On Future And Option

Nifty May 2011 futures closed at 5,536.00, at a discount of 1.15 points over spot closing of 5,537.15, while Nifty June 2011 futures were at 5,547.00 at a premium of 9.85 points over spot closing. The near month May 2011 derivatives contract expires on Thursday, May 26, 2011. Nifty May futures saw addition of 5.47% or 1.45 million (mn) units, taking the total outstanding open interest (OI) to 28.00 mn units.

From the most active underlying, SBI's May 2011 futures closed at a premium of 8.30 points at 2624.70 compared with spot closing of 2616.40. The number of contracts traded was 29,022.

ICICI Bank May 2011 futures were at a premium of 1.05 point at 1057.20 compared with spot closing of 1056.15. The number of contracts traded was 26072.

Tata Motors May 2011 futures were at a premium of 0.45 points at 1159.70 compared with spot closing of 1159.25. The number of contracts traded was 18,095.

Axis Bank May 2011 futures were at a premium of 5.00 points at 1240.00 compared with spot closing of 1235.00. The number of contracts traded was 14,863.

Tata Steel May 2011 futures were at a premium of 2.15 points at 591.40 compared with spot closing of 589.25. The number of contracts traded was 14,652.

Nifty Option Open Interest Distribution

Nifty May 5600 call added 13.37 lakh shares in OI, up 36.70% and 5700 call added 12.10 lakh shares in OI, up 20.56%. On the put side nifty May 5500 put added 6.44 lakh shares in OI, up 14.29% and 5400 put added 5.54 lakh in OI, up 13.38%. The put-call ratio of stock option increased from 0.32 to 0.34 while put-call ratio of index option increased from 0.75 to 0.83. On the whole the put call ratio was at 0.81.

Read more about Derivative Strategy On Future And Option

Related post about Derivative Strategy On Future And Option Report By Mansukh

0 comments:

Post a Comment