SNAPSHOT

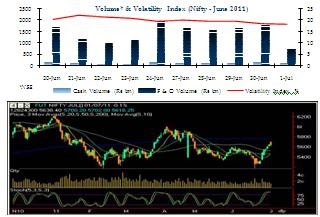

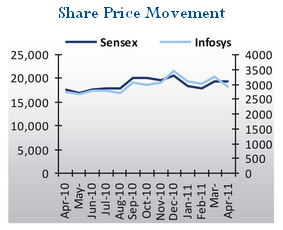

Indian equity markets, which failed to extend the winning momentum last week, resumed the northward journey by settling with close to a percent gains in the week ended July 22. The enthralling week saw the frontline indices being buttressed not only by encouraging reports from the domestic front but also by easing concerns over global financial stability. The Bombay Stock Exchange (BSE) Sensex gained 160.38 points or 0.86% to 18722.30 during the week ended July 22, 2011. The BSE Mid-cap index was up by 39.37 points or 0.56% to 7046.12 and the Small-cap index was up by 100.27 points or 1.20% to 8463.49. The S&P CNX Nifty gained 52.85 points or 0.95% to 5633.95. On the National Stock Exchange(NSE), Bank Nifty increased by 57.40 points or 0.51% to 11291.95, CNX IT surged 92.45 points or 1.46% to 6438.50 while CNX mid-cap lost 21.30 points or 0.26% to 8153.90 and CNX Nifty Junior slipped 111.70 points or 0.98% to 11278.45. India's food inflation has once again resumed its declining trajectory as the Food Articles group rose 7.58% in the week ended July 9 compared to 8.31% in the previous week. The Empowered Group of Minister (EGoM) on food headed by Finance Minister Pranab Mukherjee removed the four year ban from export export of wheat.

Meanwhile, Indian agriculture production registered a record increase of around 11% during the 2010-11 agriculture season while ministry of finance approved 31 foreign direct investment (FDI) proposals worth Rs 3844.70 core. The domestic indices were largely influenced by the encouraging developments from the Euro-zone where European Union leaders carved out a second bailout package worth 109 billion euros ($157 billion) for debt-stricken Greece in a desperate effort to contain the 18 month long debt crisis in Europe, which is threatening to spread to much larger economies.

Meanwhile, Indian agriculture production registered a record increase of around 11% during the 2010-11 agriculture season while ministry of finance approved 31 foreign direct investment (FDI) proposals worth Rs 3844.70 core. The domestic indices were largely influenced by the encouraging developments from the Euro-zone where European Union leaders carved out a second bailout package worth 109 billion euros ($157 billion) for debt-stricken Greece in a desperate effort to contain the 18 month long debt crisis in Europe, which is threatening to spread to much larger economies.

Indian equity markets, which failed to extend the winning momentum last week, resumed the northward journey by settling with close to a percent gains in the week ended July 22. The enthralling week saw the frontline indices being buttressed not only by encouraging reports from the domestic front but also by easing concerns over global financial stability. The Bombay Stock Exchange (BSE) Sensex gained 160.38 points or 0.86% to 18722.30 during the week ended July 22, 2011. The BSE Mid-cap index was up by 39.37 points or 0.56% to 7046.12 and the Small-cap index was up by 100.27 points or 1.20% to 8463.49. The S&P CNX Nifty gained 52.85 points or 0.95% to 5633.95. On the National Stock Exchange(NSE), Bank Nifty increased by 57.40 points or 0.51% to 11291.95, CNX IT surged 92.45 points or 1.46% to 6438.50 while CNX mid-cap lost 21.30 points or 0.26% to 8153.90 and CNX Nifty Junior slipped 111.70 points or 0.98% to 11278.45. India's food inflation has once again resumed its declining trajectory as the Food Articles group rose 7.58% in the week ended July 9 compared to 8.31% in the previous week. The Empowered Group of Minister (EGoM) on food headed by Finance Minister Pranab Mukherjee removed the four year ban from export export of wheat.

Meanwhile, Indian agriculture production registered a record increase of around 11% during the 2010-11 agriculture season while ministry of finance approved 31 foreign direct investment (FDI) proposals worth Rs 3844.70 core. The domestic indices were largely influenced by the encouraging developments from the Euro-zone where European Union leaders carved out a second bailout package worth 109 billion euros ($157 billion) for debt-stricken Greece in a desperate effort to contain the 18 month long debt crisis in Europe, which is threatening to spread to much larger economies.

Meanwhile, Indian agriculture production registered a record increase of around 11% during the 2010-11 agriculture season while ministry of finance approved 31 foreign direct investment (FDI) proposals worth Rs 3844.70 core. The domestic indices were largely influenced by the encouraging developments from the Euro-zone where European Union leaders carved out a second bailout package worth 109 billion euros ($157 billion) for debt-stricken Greece in a desperate effort to contain the 18 month long debt crisis in Europe, which is threatening to spread to much larger economies.