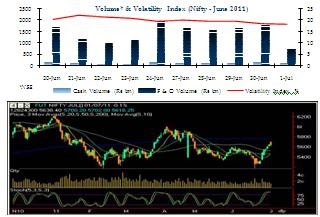

Indian benchmark indices failed to extend the winning run for the fourth straight week and halted the weekly uptrend with around one and half a percent losses. The eventful week saw the frontline indices being tormented not only because of domestic reasons but also by worsening global financial situation. The markets got off to a subdued opening for the week as last Friday's pessimism got spilled into Monday's session. What unfolded in the next couple of days was a nasty cut of over one and half a percent followed by a recuperation of around a percentage points. The bourses were destined for similar fortune in the next two days as well but the magnitude of gains and losses was moderate. Then came the extremely disappointing IIP numbers for the month of May which unexpectedly slowed to 5.6% from a year earlier, confirming the signs that the economy is losing steam after a string of interest rate hikes by RBI. Meanwhile, monthly WPI inflation numbers released by the government gave some respite to the markets as it increased to 9.44% in June against 9.06% in the previous month, whereas economists had forecast a gloomier picture and a sharper rise to 9.7% because of the recent hike in prices of petroleum products by the government.

However, the relief proved temporary as weak monsoon data took its toll on sentiments. The Bombay Stock Exchange (BSE) Sensex lost 296.12 points or 1.57% to 18561.92 during the week ended July 15, 2011. The BSE Mid- cap index gained marginally by 10.44 points or 0.15% to 7006.75 and the Small-cap index lost 11.92 points or 0.14% to 8363.22. The S&P CNX Nifty declined by 79.55 points or 1.41% to 5581.10. On the National Stock Exchange (NSE), Bank Nifty lost 50.60 points or 0.45% to 11234.55, CNX IT slipped 377.80 points or 5.62% to 6346.05 while CNX mid- cap increased by 59.30 points or 0.73% to 8175.20 and CNX Nifty Junior gained 33.40 points or 0.29% to 11390.15.

However, the relief proved temporary as weak monsoon data took its toll on sentiments. The Bombay Stock Exchange (BSE) Sensex lost 296.12 points or 1.57% to 18561.92 during the week ended July 15, 2011. The BSE Mid- cap index gained marginally by 10.44 points or 0.15% to 7006.75 and the Small-cap index lost 11.92 points or 0.14% to 8363.22. The S&P CNX Nifty declined by 79.55 points or 1.41% to 5581.10. On the National Stock Exchange (NSE), Bank Nifty lost 50.60 points or 0.45% to 11234.55, CNX IT slipped 377.80 points or 5.62% to 6346.05 while CNX mid- cap increased by 59.30 points or 0.73% to 8175.20 and CNX Nifty Junior gained 33.40 points or 0.29% to 11390.15.