SNAPSHOT

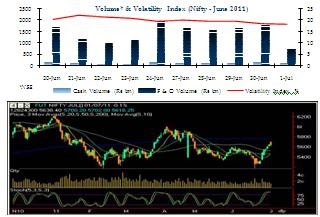

Boisterous Indian benchmarks witnessed an awe-inspiring week of trade as they carried forward their exhilaration from the previous week and vivaciously rallied over 1,250 (Sensex) and 350 (Nifty) points from last Thursday to this Thursday. However, the frontline indices receded on Friday, halting a six-day advance, as some investors judged the recent rally as excessive and resorted to profit booking on speculations that fundamentally things have not changed much and also on expectations that Reserve Bank of India would continue its tightening measures until there are clear signs of inflation easing. Nevertheless, the frontline indices accumulated around three percent points for the week, the largest weekly gain since late March as optimistic global cues coupled with encouraging local developments fortified investors' mood. Foreign institutional investors showed renewed vigor in Indian equities following the government's decision to hike prices of petroleum products while the reduction in customs and excise duty came as an incremental positive surprise for them. The net FII inflow in the equity stood at over Rs 4,600 crore till Thursday.

The core infrastructure industries registered a slowdown in the pace of growth in the month of May, coming down at 5.3% compared to 7.4% registered in May 2010, mainly due to increased interest rates and confusion on policies. The RBI has raised interest rates 10 times since March 2010 to tame inflationary pressures and has made its intention clear to sacrifice some growth to calm inflation. The food inflation numbers showed signs of cooling in the week ended June 18, According to the data released by Ministry of Commerce and Industry, the index for Food Articles group rose to 7.78% for the week-ended June 18, from 9.13% for the previous week.

0 comments:

Post a Comment