SNAPSHOT

With an exception of the last trading day of the week, Indian benchmarks showed high-spirited performance in four back to back sessions of the passing week as they extended last Friday's pullback rally with bottom fishing in fundamentally strong shares gathering greater force. Markets finally witnessed the much needed relief as they commenced the week with around 500 points rally,though took a couple of days off to consolidate and then made another move upto 5,500 on Thursday. However, all the good work was partly undone by Friday's trade as the frontline indices capitulated to the selling pressure exerted by bears of the market. Meanwhile India VIX, a gauge for market's short term expectation of volatility, gained 7.13% at 24.18 from its previous close of 22.57 on Thursday (Provisional).

WEEK GONE BY

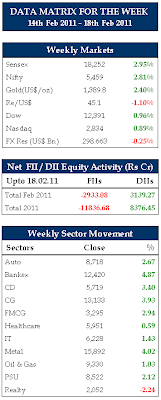

The Bombay Stock Exchange (BSE) Sensex surged by 482.91 points or 2.72% to 18211.52 during the week ended February 18, 2011 while the S&P CNX Nifty was up by 148.95 points or 2.81% to 5458.95. The BSE Mid-cap index was up by 2.87% to 6661.65 and the Small-cap index zoomed by 4.10% to 8128.91. On the National Stock Exchange (NSE), CNX Nifty Junior dipped 3.00% to 10406.25, CNX IT tumbled 1.91% to 6719.65 and CNX midcap was the worst performer, declining by 3.45% to 7483.9. On the other hand Bank Nifty closed flat, up by 0.13% to 10447.75. In the BSE sectoral space, there was only one loser, Realty down by 2.24% for the week to snap the week at 2052.11. On the other hand, Bankex was the biggest gainer up by 4.87% to 12419.72, followed by Metal up by 4.02% to 15892.31, Capital Goods (CG) up by 3.93% to 13132.51, Consumer Durables (CD) up by 3.40% to 5719.04, Fast Moving Consumer Goods (FMCG) up by 2.94% to 3295.36, Auto up by 2.67% to 8717.71, Public Sector Undertakings (PSU) up by 2.12% to 8522.38, Power up by 2.09% to 2611.98 and TECk up by 1.53% to 3647.97.

0 comments:

Post a Comment